seattle payroll tax ordinance

The rules clarify several areas of uncertainty in how the ordinance will be implemented. Adding a new Chapter 537 and a new Chapter 538 to.

Council Discusses Details Of Proposed Payroll Tax

The text of the citys JumpStart tax.

. And the employee resides in Seattle. Attachment 1 to this ordinance establishes the proposed spending plan for the 9 first five years of the tax on corporate payroll. A smaller employer with a total payroll of less than 7 million is not subject to tax.

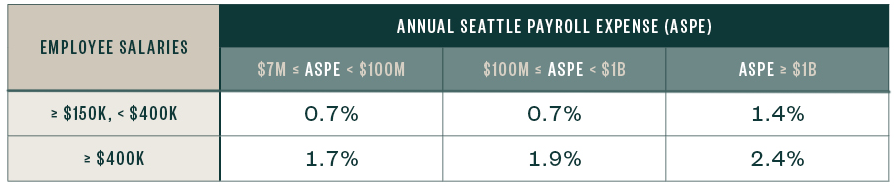

Imposing a payroll expense tax on persons engaging in business in seattle. The payroll expense tax is a tax on employers that have Seattle annual payroll expense of 7 million or more. For example in 2021 businesses that had 7 million or more in Seattle payroll expenses in 2020 would apply the tax rates based on their 2021 Seattle payroll expense of employees with.

Adding a new chapter 5. The council amended the tax ordinance earlier this year to try to avoid such a challenge but the courts will have the. The tax will be imposed on businesses and organizations with at least 7 million of Seattle annual payroll expense Filing Frequency The 2021 payroll expense tax annual return and payment will be due January 31 2022.

1 applies to businesses with annual payroll costs of at least 7 million. Implementation and administrative costs. Amending the payroll expense tax on persons engaging in business in Seattle.

The Seattle payroll tax which took effect Jan. The spending plan may be amended from time to 10 time by the City Council by ordinance. Imposing an employee hours tax that will be replaced by 6 a business payroll tax in 2021.

Imposing a payroll expense tax on persons engaging in business in Seattle. City of Seattle-LTA PO Box 34907 Seattle WA 98124-1907 The payroll expense tax in 2022 is required of businesses with. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle.

Businesses pay the tax for each employee who makes 150000 a year or. 1 applies to businesses with annual payroll costs of at least 7 million. Employers cannot deduct the amount of tax from their employee compensation.

While the ordinance has not yet been signed by the mayor as of publication the tax was passed by the council on July 6 2020 by a veto-proof majority 7-2 and is expected to become law effective January 1 2021. 1 2022 and on January 1 of every year thereafter the dollar thresholds will increase based on the rate of. LEG Employee Hours and Business Payroll Tax ORD D1 Template last revised August 15 2016 1 1 CITY OF SEATTLE 2 ORDINANCE _____ 3 COUNCIL BILL _____ 4 title 5 AN ORDINANCE relating to taxation.

The payroll expense tax takes effect on January 1 2021 with a sunset date of December 31 2040. While the ordinance has not yet been signed by the mayor as of publication the tax. An overview of the ordinance follows.

Any remaining proceeds from the payroll tax are intended to be used as follows. CITY OF SEATTLE. The ordinance takes effect at the start of 2021 and sunsets at the end of 2040.

And adding a new Section 538025 to the Seattle Municipal Code. The vast majority of Seattle businesses will not be subject to the tax because the ordinance excludes businesses with less than 7 million of annual Seattle payroll and does not place an assessment on salaries under 150000. On July 6 2020 the Seattle City Council voted 7-2 to pass Council Bill 119810 which imposes a Seattle payroll expense excise tax on large employers.

1 exacts a 07 tax on payroll 150000 and over for businesses with annual payrolls of 7 million or. And amending Sections 530010 530060 555010 555040 555060 555150 555165 555220 555230 and 6208020 of the Seattle Municipal Code. For employees who perform work partly within and partly outside seattle the compensation paid in seattle to those employees shall be for each individual employee the portion of the employees annual compensation which the total number of the employees hours worked within seattle bears to the total number of the employees hours worked within.

AN ORDINANCE relating to taxation. 7386494 or more of payroll expense in Seattle for the past calendar year 2021 and compensation in Seattle for the current calendar year 2022 paid to at least one employee whose annual compensation is 158282 or more. Adding a new Chapter 538 to the Seattle Municipal Code.

Seattle has proposed rules for its new payroll expense tax that took effect January 1 2021. This carefully crafted revenue proposal is thoughtful in its requirement that only the largest companies with the. And amending Sections 530010 530060 555010 555040 555060 555150 555165 555220 555230 and 6208020 of the Seattle Municipal Code.

1 while the so-called jumpstart tax is currently awaiting signature by seattle mayor jenny. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. However businesses must use the current years compensation paid in Seattle to determine the payroll expense tax due for the year.

AN ORDINANCE relating to taxation. On July 6 2020 the Seattle City Council approved an ordinance for a JumpStart payroll expense tax imposed on businesses operating in Seattle with some exceptions. The move which went into effect Jan.

One of those will probably be an employer with no offices in seattle but that has employees who live in seattle and work remotely from home at least part of the time and are required to pay the payroll tax on those employees. The City of Seattle has finalized their rule on the new payroll expense tax which became effective January 1 2021. An ordinance relating to taxation.

To administer the payroll tax authorized by the ordinance introduced as Council Bill 119810 and to administer the investments described in subsections 2A2 and 2A3 of this ordinance. The seattle city council recently approved a new payroll expense tax which will apply to businesses operating in seattle with at least 7 million in annual payroll at a rate of 07 -14 on employee salaries over 150000 beginning on jan. The draft rules address areas of ambiguity in the ordinance adopted by the Seattle City Council in July see PwCs Insight for more on the new payroll expense tax law.

The tax will be used to provide services to Seattles low-income population. Amending Section 538020 of the Seattle Municipal Code. The Seattle payroll tax which took effect Jan.

Section 538020 of the Seattle Municipal Code enacted by Ordinance 126108 is amended as follows. We previously issued a blast on this ordinance with details on how this tax applies to businesses. The applicable tax rate depends on the total amount of the employers Seattle payroll and the taxable compensation of its employees earning more than 150000 per year.

The ordinance includes a provision allowing apportionment of payroll expense for payroll related to work done and.

How Amazon Killed Seattle S Head Tax The Atlantic

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Seattle Payroll Expense Tax New Rule And Guidance Issued Berntson Porter Company Pllc

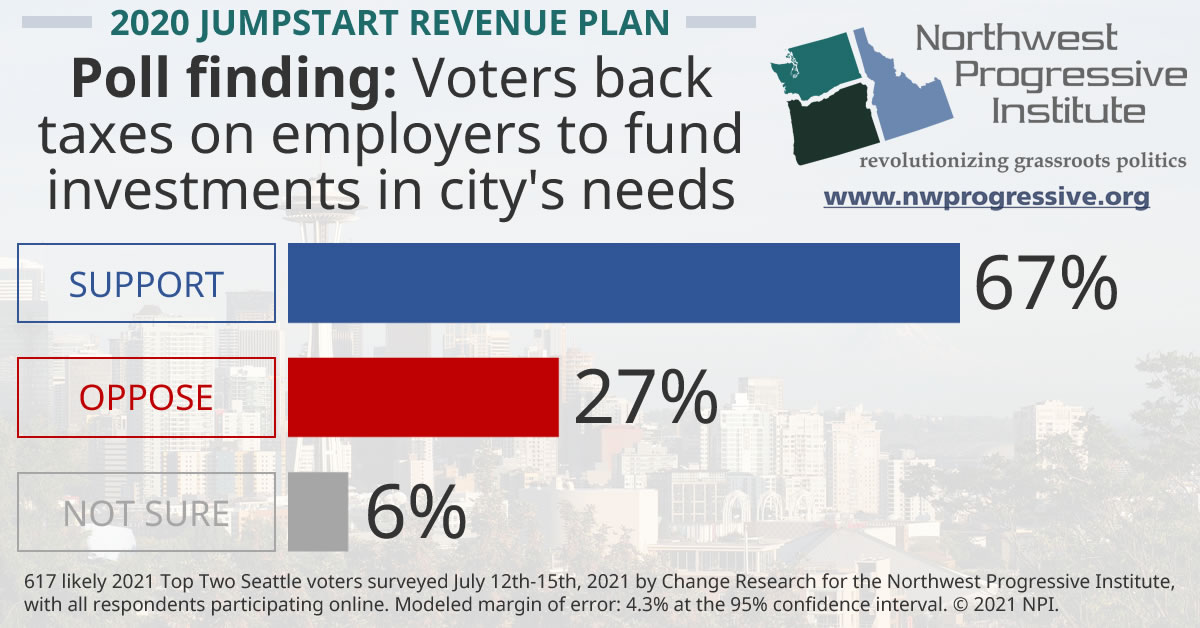

Npi S July 2021 Survey Of Seattle Voters Found Deep Support For Jumpstart Revenue Plan Npi S Cascadia Advocate

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Amazon Payroll Subject To New Seattle Tax And Jeff Bezos Is Wealthier Than Ever Washington Business Journal

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Why The Challenge To Seattle S Payroll Tax Will Fail And Should Fail Post Alley

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

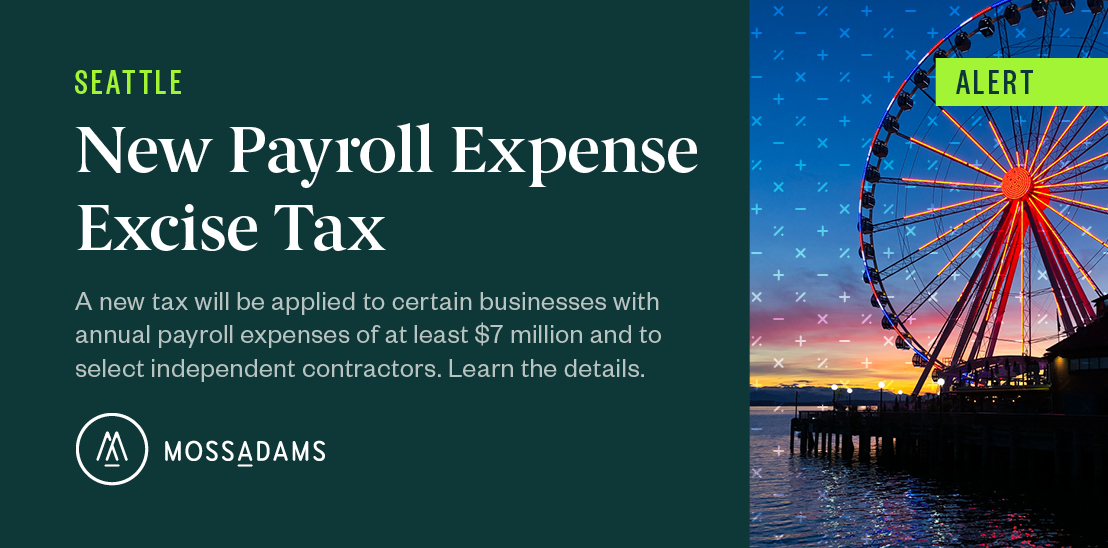

Seattle Payroll Expense Excise Tax Details

Council Discusses Details Of Proposed Payroll Tax

How Seattle S New Payroll Tax On Amazon And Other Big Businesses Will Work Geekwire

Seattle Jumpstart Tax Hkp Seattle

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Seattle Payroll Expense Excise Tax Details

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax